Itemizes Closing Costs And Explains Terms Of Loan . Learn what they cover, how they are. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Find out who pays the title. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close.

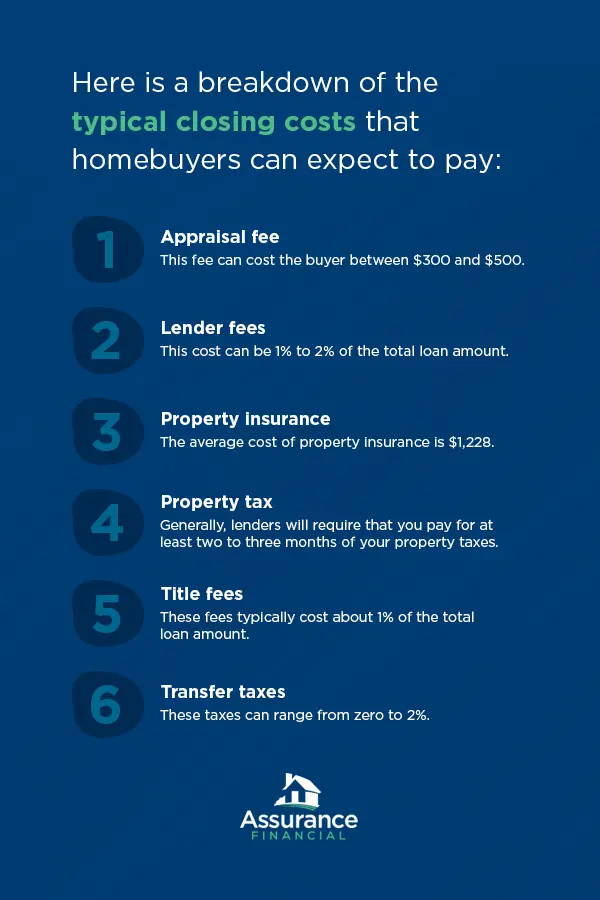

from assurancemortgage.com

learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Find out who pays the title.

How to Estimate Closing Costs Assurance Financial

Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. Find out who pays the title. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Learn what they cover, how they are. learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. the loan estimate provides details about the terms of your loan and an estimate of the closing costs.

From www.lendingtree.com

Understanding Mortgage Closing Costs LendingTree Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. . Itemizes Closing Costs And Explains Terms Of Loan.

From tamisavage.com

Facts About Closing Costs [INFOGRAPHIC] Tami Savage, Realtor Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash. Itemizes Closing Costs And Explains Terms Of Loan.

From worksheetdbkneel.z19.web.core.windows.net

Closing Cost Itemized Fee Worksheet Itemizes Closing Costs And Explains Terms Of Loan the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. learn about the common fees associated with purchasing a home, such as origination,. Itemizes Closing Costs And Explains Terms Of Loan.

From www.gonovamac.com

Home Loans 101 What are Closing Costs? Itemizes Closing Costs And Explains Terms Of Loan the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Learn what they cover, how they are. Find out who pays the title. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. closing costs are the fees and charges. Itemizes Closing Costs And Explains Terms Of Loan.

From cbwarburg.com

Estimated Closing Costs Coldwell Banker Warburg Coldwell Banker Warburg Itemizes Closing Costs And Explains Terms Of Loan Find out who pays the title. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. learn about the. Itemizes Closing Costs And Explains Terms Of Loan.

From closingcostskoroshibu.blogspot.com

Closing Costs Breakdown Of Closing Costs Itemizes Closing Costs And Explains Terms Of Loan Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. learn about the common fees associated with purchasing a. Itemizes Closing Costs And Explains Terms Of Loan.

From flagency.net

Understanding Your Loan Estimate Terms, Payments and Closing Costs Itemizes Closing Costs And Explains Terms Of Loan closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Learn what they cover, how they are. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Itemizes closing costs, typically ranging from 3% to 6% of. Itemizes Closing Costs And Explains Terms Of Loan.

From closingcostskoroshibu.blogspot.com

Closing Costs Loan Closing Costs Amortization Itemizes Closing Costs And Explains Terms Of Loan learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. Find out who pays the title. Learn what they cover, how they are. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. closing costs are the fees. Itemizes Closing Costs And Explains Terms Of Loan.

From mint.intuit.com

Closing Costs Calculator Find Out How Much You Could Pay MintLife Blog Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Learn. Itemizes Closing Costs And Explains Terms Of Loan.

From www.youtube.com

Home Loan Closing Costs Fully Explained + Breakdown YouTube Itemizes Closing Costs And Explains Terms Of Loan closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. Find out who pays the title. learn about the documents you should receive before closing on. Itemizes Closing Costs And Explains Terms Of Loan.

From assurancemortgage.com

How to Estimate Closing Costs Assurance Financial Itemizes Closing Costs And Explains Terms Of Loan the loan estimate provides details about the terms of your loan and an estimate of the closing costs. learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate,. Itemizes Closing Costs And Explains Terms Of Loan.

From www.homeswithneo.com

Understanding Mortgage Closing Costs NEO Home Loans Blog Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Learn what they cover, how they are. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Find out who pays the title. learn about the common fees associated with. Itemizes Closing Costs And Explains Terms Of Loan.

From ezfundings.com

All you Need to Know About Home Loan Closing Costs & Fees Detailed Itemizes Closing Costs And Explains Terms Of Loan Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. Find out who pays the title. closing costs are the fees and charges. Itemizes Closing Costs And Explains Terms Of Loan.

From www.youtube.com

Seller Closing Costs Explained and Estimated YouTube Itemizes Closing Costs And Explains Terms Of Loan Learn what they cover, how they are. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. learn about the common fees associated with purchasing a home, such as origination,. Itemizes Closing Costs And Explains Terms Of Loan.

From www.bankrate.com

Loan Estimate Guide Closing Costs Itemizes Closing Costs And Explains Terms Of Loan learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed. Itemizes Closing Costs And Explains Terms Of Loan.

From homeabroadinc.com

Mortgage Closing Process All You Need to Know About Your Closing and Itemizes Closing Costs And Explains Terms Of Loan learn about the documents you should receive before closing on a mortgage loan, such as the loan estimate, closing. learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. Find out who pays the title. Itemizes closing costs, typically ranging from 3% to 6% of the loan. Itemizes Closing Costs And Explains Terms Of Loan.

From reverse.mortgage

Reverse Mortgage Closing Costs & Fees Explained Itemizes Closing Costs And Explains Terms Of Loan Learn what they cover, how they are. closing costs are the fees and charges paid by buyers and sellers to finalize a real estate transaction and a home loan. Itemizes closing costs, typically ranging from 3% to 6% of the loan amount, and includes the cash needed to close. learn about the common fees associated with purchasing a. Itemizes Closing Costs And Explains Terms Of Loan.

From assurancemortgage.com

How to Estimate Closing Costs Assurance Financial Itemizes Closing Costs And Explains Terms Of Loan Find out who pays the title. learn about the common fees associated with purchasing a home, such as origination, points, appraisal, credit report, title insurance, and more. the loan estimate provides details about the terms of your loan and an estimate of the closing costs. learn about the documents you should receive before closing on a mortgage. Itemizes Closing Costs And Explains Terms Of Loan.